SOLUÇÕES EFICAZES?

DESENVOLVIMENTO

em constante busca por novas tecnologias de usinagem, automação industrial

e controles da Indústria 4.0.

princípios da Manufatura Enxuta.

Colaboradores

Desenvolver soluções em usinagens especiais de alta qualidade

Certificado ISO 9001:2015

Sistema de Gestão da Qualidade

Desde 1999 entregamos aos nossos clientes produtos de alta qualidade. Trilhamos um caminho exponencial nos últimos anos guiado por valores fortes como integridade, honestidade e valorização do ser humano. A INDEX se tornou uma empresa especialista em usinagem seriada de precisão, fundamentada pelos princípios do Lean Manufacturing e conduzida por uma equipe de Engenharia e Qualidade altamente qualificada e engajada, buscando sempre soluções inovadoras e tecnológicas, visando a entrega de produtos de alta qualidade que supere as expectativas dos clientes.

NOSSOS SERVIÇOS

Usinagem seriada de alta precisão

Pesquisa e Desenvolvimento

Com o foco na pesquisa de processos de usinagem inovadores, este time está em constante busca por novas tecnologias de usinagem, automação industrial e controles da Indústria 4.0.

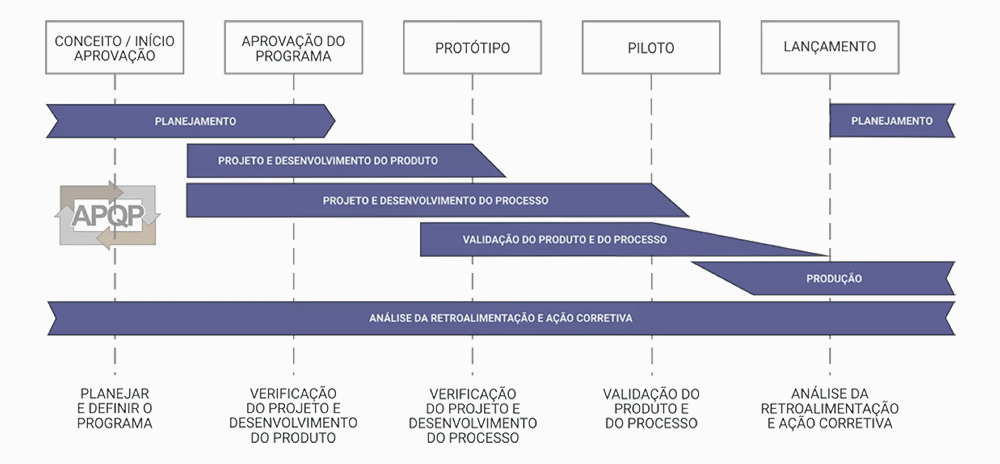

Desenvolvimento de Novos Produtos

Esta área atende às solicitações rigorosas dos nossos clientes empregando as metodologias mais atualizadas de desenvolvimento de produto tais como o APQP (Advanced Product Quality Planning). Com esta metodologia buscamos integração com nossos clientes através de Design Review desde as fases iniciais do desenvolvimento, assegurando completo entendimento das necessidades e requisitos do produto.

Melhoria Contínua:

Área com a missão de melhorar continuamente a qualidade e produtividade dos processos Index. Para isso são empregadas técnicas de cronoanálise, otimização de processos bem como os princípios da Manufatura Enxuta (Lean Manufacturing)

QUALIDADE

Sistema de Gestão da Qualidade: a Index conta com a certificação ISO9001, confirmando o alto nível de qualidade dos processos de produção.

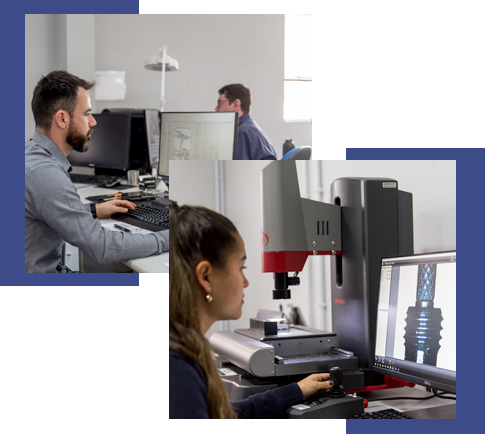

Controle da Qualidade de Alta Tecnologia: empregamos a mais alta tecnologia para controle dos processos produtivos, incluindo laboratórios com Máquinas de Medição por Coordenadas Zeiss, equipamentos de medição ótica de última geração dentre outros.

Melhoria Contínua: com integração permanente com a Engenharia de Processos, o time da Qualidade emprega as metodologias de análise e solução de problemas mais atualizadas e de padrão automotivo como a metodologia 8D da Ford e a metodologia A3 da Toyota.

POLÍTICA DE QUALIDADE

“A Index Usinagem tem como seu fundamental propósito fornecer serviços de usinagem que supere as expectativas de seus clientes através da busca pela inovação, cumprimento dos requisitos regulamentares e requisitos específicos dos clientes, capacitação de colaboradores e da melhoria contínua de seus processos internos e do Sistema de Gestão da Qualidade.”

OBJETIVOS DA QUALIDADE

- Atender as necessidades do cliente

- Buscar inovação

- Cumprir requisitos do Cliente

- Capacitar Colaboradores

- Melhorar continuamente o sistema de gestão da qualidade

- Crescer de forma controlada e consolidada

fornecer sempre as melhores soluções.

Desde 1999 entregamos aos nossos clientes produtos de alta qualidade. Uma empresa especializada em usinagem de precisão e peças técnicas seriadas que visa à melhoria continua de seus processos internos e serviços que oferecemos.

ALGUNS CLIENTES

FAÇA SEU PROJETO COM A INDEX

FUNCIONAMOS 24H

QUALIDADE E CERTIFICAÇÃO